As a long term investor, I have not touched crude oil trade until recently. This post is for the ones who wants learn about trading or investing in Oil as a commodity.

What is Crude Oil?

Crude oil is the world economy’s primary energy source, making it a very popular commodity to trade. A naturally occurring fossil fuel, it can be refined into various products like gasoline (petrol), diesel, lubricants, wax and other petrochemicals. It is highly demanded, traded in volume, and extremely liquid. Oil trading therefore involves tight spreads, clear chart patterns, and high volatility.

Brent crude is the world’s benchmark for oil with almost two thirds of oil contracts traded being Brent oil. WTI is America’s benchmark oil, it is a slightly sweeter and lighter oil compared to Brent.

WTI trades on CME Globex: Sunday – Friday, 6:00 p.m. – 5:00 p.m. (with an hour break from 5:00 p.m. to 6:00 p.m each day) while Brent trades on ICE: Sunday – Friday – 7:00 p.m. – 5:00 p.m.

Trade NYMEX WTI Crude Oil futures (CL), the world’s most liquid crude oil contract. When traders need the current oil price, they check the WTI Crude Oil price. WTI (West Texas Intermediate, a US light sweet crude oil blend) futures provide direct crude oil exposure and are the most efficient way to trade oil.

How to monitor Crude Oil price on your iPhone Stocks App?

Crude Oil WTI is traded in the Futures Market. It is not like a stock that you can buy and hold. You trade CL as a futures contract. If you trade one contract that is equal to 1000 barrels. If one barrel cost $23, then contract value is $23K. One barrel contains 42 Gallons (159 Liters).

CL=F shows you the current month. Today is May 6th so current CL contract is for June. June contract has an expiry date of May 19th. You can check the calendar from CME Group

On the 19th May June contract will expire and July contract will become the active traded contract.

How can OIL price turn negative?

The price of US oil has turned negative for the first time in history.

That means oil producers are paying buyers to take the commodity off their hands over fears that storage capacity could run out in May.

Demand for oil has all but dried up as lockdowns due to Covid-19 across the world have kept people inside.

As a result, oil firms have resorted to renting tankers to store the surplus supply and that has forced the price of US oil into negative territory.

The price of a barrel of West Texas Intermediate (WTI), the benchmark for US oil, fell as low as minus $37.63 a barrel.

Sounds all good right? Easy …. Immmm… Let’s try a different way to explain the situation.

Why WTI Crude Oil traded at minus -$37

Imagine the following…you pay $500 today and commit to receiving an escort at your house in 15 days. Cos your wife is traveling. This is called a futures contract.

Unfortunately, lockdown came and your wife will be home for the next 60 days.

You do not want this woman to show up at your house at all and try to pass this futures contract to someone else.

Only you cannot sell this commitment because nobody can receive the escort at home anymore. Everyone is in full storage (their balls) with wife.

To make matters worse, not even the pimp (Chicago Mercantile exchange) has more room to receive girls because his house is crowded with girls.

So you will pay anyone just to take the girl off your hands.

Do you now understand why oil has a negative price when the contract is delivered?

Invest in Oil through ETFs

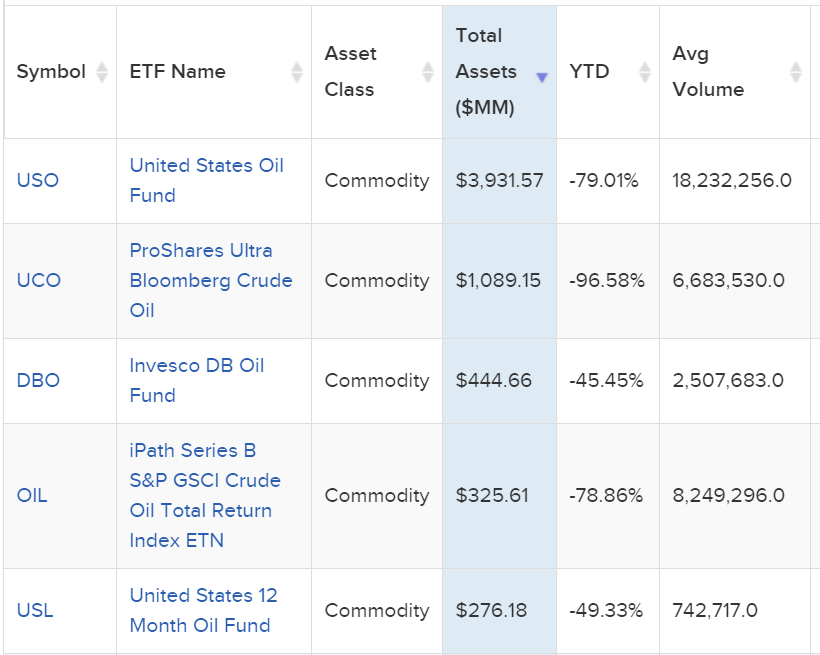

Another direct method of owning oil is through the purchase of commodity-based oil exchange-traded funds (ETFs). ETFs trade on a stock exchange and can be purchased and sold in a manner similar to stocks. For example, buying one share of the U.S. Oil Fund (USO) would give you exposure to roughly one barrel of oil. The fund’s investment objective is to provide daily investment results corresponding to the daily percentage changes of the spot price of West Texas Intermediate (WTI) crude oil to be delivered to Cushing, Oklahoma.

USO is the largest Oil ETF holding $3.9bn of oil contracts. This ETF however was not prepared for spot oil price to go negative. USO was only investing all its funds in to next month’s future contract. USO used to buy the next month’s contract on 5th of each month. Contracts exchanged around 19-21 of each month.

An historical moment in April forced USO to change its ETF structure. May Contract was going towards negative territory while June contract trading at around $20. So when USO sells the current month and buys the next month contract, the fund would be hammered with the unusual price difference. For ex 1000 contracts selling at $5 and then buying $20 contracts with that money. That would mean 75% loss!!

In April USO restructured the fund to invest in the next 6 months futures contracts. You can check the USO holdings from this site. My favourite ETF for oil is USL. USL is investing in the next 12 months CL futures contracts equally. So it is less prune to Contango and Backwardation. It is outperforming the most well known oil ETF USO.

DBO is also a good choice according to its performance but it is structured very differently. DBO optimizes exposure to the curve to combat contango by rolling into whichever contract month (within the next 13) looks most attractive by its rules, rather than rolling front-month contracts.

Contango and Backwardation Terms Explained

When a future month contract price is higher than the current month contract this is called Contango. If a future month contract price is lower than the current month then this is called Backwardation. In April 2020 we saw the biggest contango ever in the history of oil trade. Under normal circumstances future month contracts add around $1 for each month in price. This is logical because you lock a deal with a producer to secure and store the oil for you to be delivered in a future date. The contango is the price of storage, shipment and security.

In April May contract was at -$37.63 and June was $21.14. That is a contango of $58.77. You can even trade on this spread. I traded the spread of July/August which was more stable compared to the current month. I was able to cash some money by shorting the spread from daily trade. You can also watch this short video to better understand these terms.

Invest in Oil through Energy Stocks

Chevron, Exxon, BP and Shell are solid energy stocks paying high yield dividends. These stocks are compared in detail in this article. For long term investors Chevron and Exxon are my top choices.

Key takeaways

- If you have more than $25K to invest in OIL and you understand how Futures contracts work, then go directly in CL Futures. Each month in the future you pay a price premium. Try to find a sweet spot. I chose Feb 2021 contract for ex as a long term trade.

- Decide whether you want to buy and hold over a long period of time thinking Oil price will rebound. If the answer is YES then consider an Oil ETF.

- If you are looking for a day trade or short term strategy then CL current month is the best as it is traded in high volumes and very volatile.

- Oil price is highly dependent on Supply and Demand balance. Try to understand what impacts Supply and Demand to predict future Oil price.