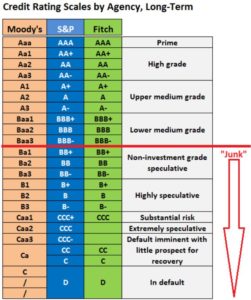

There are three main agencies called S&P, Moody’s and Fitch who are doing this job for us. They continuously review the financial status of the country and update the ratings accordingly. Have a look at the comparison scale below ( source can be found here )

It is a good summary however it is considering Corporate and Government Bonds. I personally do not like and trade Corporate Bonds as I find them quite riskier than Government Bonds. For ex an A rated company’s CEO can pass away, problems bringing a product to market or company get into financial difficulty and not to be able to pay your coupons. If you believe in that company so much then why do not buy its Stock shares instead of Bonds? Governments on the other hand are a different story because they do not easily go bust (default), they collect taxes, have real estates, factories and they are credit worthy. How do you know which Governments have defaulted in the past?

As a free resource, you can visit this Wikipedia article. If I check for the bonds I am holding Egypt and Costa Rica’s last default was 1984, Mexico’s was 1982. They are currently rated by S&P as Egypt grade B (coupon 8.5%), Costa Rica as grade B+ (coupon %7.1), Mexico BBB+ (coupon 4.6%). Egypt is the riskiest according to the rating and therefore paying more coupon where Mexico is the safest with the lowest coupon. On the other side, none of my bond holdings defaulted since 1984 that is really something. Not defaulted means they were able to pay the coupons of their issued bonds.

For me a Junk grade for Sovereigns are B- and below. I do not touch them. If you compare to Stock Market Crisis since 1984 you can find 1987, 2000 and 2008 crisis where US stock market sank somewhere between 30% to 50%. If you have invested in these bonds instead of the index you would have an amazing return better than the index and not missed a single coupon payment on time. That is my thinking of increasing returns whilst minimizing the risk. There is always a balance you have to decide for yourself how much risk are you willing to take? If you are happy with 10% return then you can follow my path. If you want more than 10% annual return and balance your portfolio then read my page The Money Making Machine.