If you have decided to invest in cryptocurrency and thinking how to start, you have found the right page!

First thing first is to find a platform to buy cryptocurrency.

Choose an exchange

I would choose an exchange according to your location. If you are based in;

Criteria for choosing an exchange

- Safety : Like everything else safety first. The bigger the exchange more difficult for its to go bankrupt. Security of your account is so important. If the exchange gets hacked than you have a possibility of losing all your money. The bigger the exchange more investment in security.

- Funding Options : Some exchanges only offer credit card payments, some offer wire transfers, some only accept crypto. I am looking for wire transfers as I was trading in more than $50K cash no way I could rely on my credit card for funding. In 2019 governments made it more difficult to wire transfers as they do not want cryptocurrency investment to take off. Governments cannot control and tax you with your cryptocurrency account. They are trying to change legislation to change this though.

- Ease of Use : User interface for trading is very important. You should easily login, monitor your portfolio performance, have options in advanced orders like trail stop, stop limit, limit, market orders, conditional orders etc.

- Commissions : I put commissions as the last priority. If you are a day trader in crypto then you should raise this priority. If you are an investor with a strategy in place you should not be doing many trades so commissions would be the last thing you need to worry.

Choose your cryptocurrencies

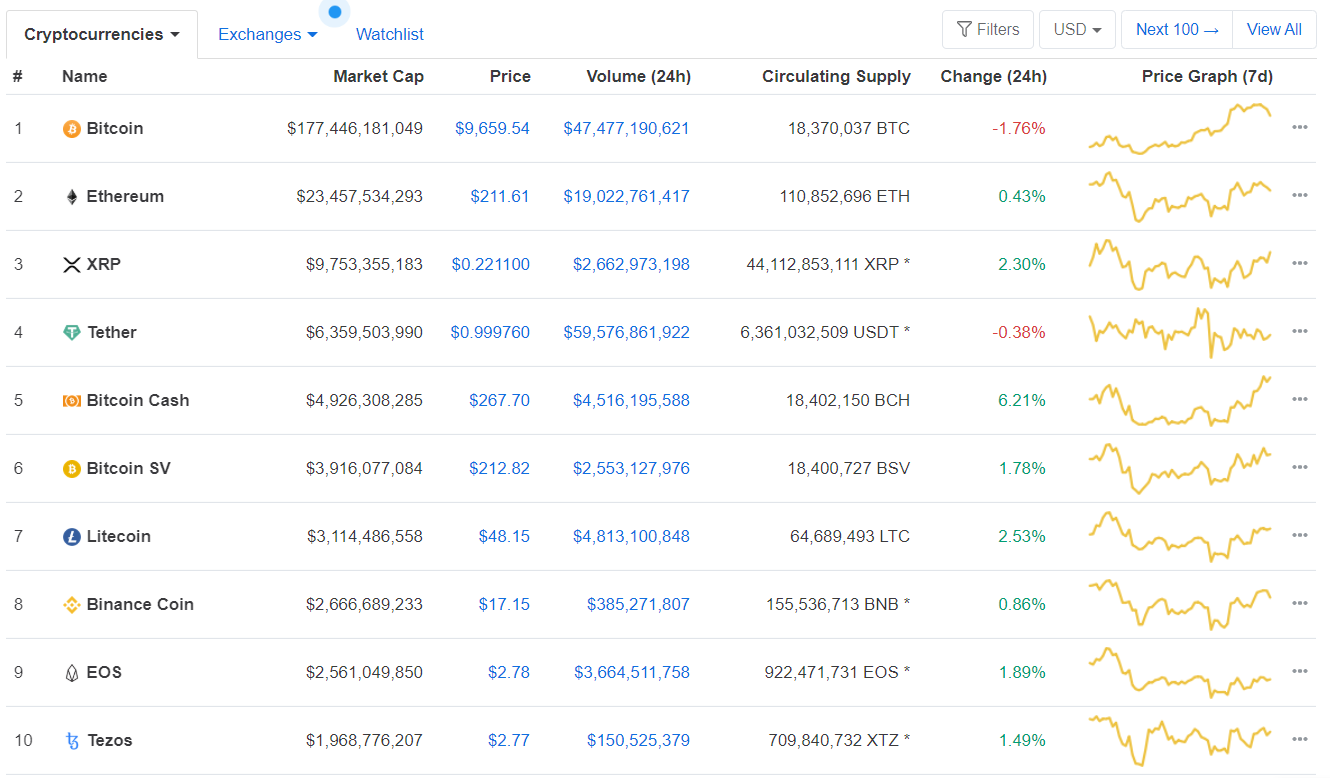

Check out coinmarketcap.com to view a list of cryptocurrencies by their market capitalization.

I would stick to top three Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) as I do not know much about the other coins. Big market moves led by Bitcoin (BTC). Check out the dominance of BTC by its market cap at $177bn. Small coins are very speculative.

Have a strategy in place

This is the most important step. I know a lot of people invested in cryptocurrency and lost significant amount of money. The main reason of losing money is the lack of strategy. Have an entry and exit plan. For example your first trade is to buy a Bitcoin (BTC) at $10K. Ask yourself these questions;

- How much am I prepared to lose?

- 10% loss means $1K in cash. What about a 50% loss at $5K?

- Note that you can setup stop-loss orders to protect your investment.

- What is the time frame am I looking to invest?

- Get rich quick scheme by gambling your money in a couple of weeks?

- Think where BTC is gonna be in a couple of yours or five years? Can you wait?

- How much am I prepared to win?

- Do you have an exit strategy? If you made 50% at $5K profit, is it good enough?

- Note that you can setup take profit orders to implement this strategy.

I was lucky enough to catch crypto in 2017 when BTC took off from $10K to $20K in just one month. My strategy was to risk a small percentage of my investment portfolio 2% and go with the momentum until I had 100% gain. I was prepared to lose all my investment in crypto if things would not go according to the plan. So I locked in my strategy and started. I then saw in a matter of weeks I hit my target 100% target. This was way too fast.

Woohooo instead of being more greedy I stuck to my strategy and cashed out my capital investment. At that point I left all my profit in the exchange and looked for new Buy opportunities. I re-invested in BTC at $6K with a target of 100% gain again. At the time of this post BTC is trading at $9.6K. When it reaches $12K I will cash out and realize some good profit. This would mean tripling my initial crypto investment.

According to my all time favorite investment book “A Random Walk Down Wall Street” , it has been revised as 12th Edition to review Cryptocurrencies whether it is a bubble or not. Bitcoin is classified as a bubble indeed.

There you go, you know my story in cryptocurrencies now. Every investor or trader may have a different take in crypto investing. My advice to you would be sticking to a strategy you trust or develop. Good luck!