If you are thinking about trading in the oil market then you should understand the impact of Supply and Demand. Oil is the most traded commodity. The oil industry is an economic powerhouse and the movements of oil prices are closely watched by investors and traders. Changes in oil prices can send shock waves throughout the global economy. Every movement on the production and consumption side of oil is reflected in the price.

There are many variables that affect the price of oil, but let’s take a look at how one of the most basic economic theories, supply and demand, impacts this precious commodity. The law of supply and demand states that if supply goes up then prices will go down. If demand goes up then prices will go up. So the key question is, what affects the supply and demand of oil?

As for the United States, its proven reserves are less impressive than its current capacity. The U.S. has 36.5 billion barrels in reserve, far behind Canada (170 billion), Iran (158 billion), Iraq (143 billion), and Kuwait (102 billion). The remaining countries ahead of the U.S. include some cordial ones (the United Arab Emirates, 98 billion), some antagonistic ones (Russia, 80 billion) and some whose friendliness is tentative (Libya, 48 billion.)

Top 10 Largest Consumers of Oil (Demand)

According to Wikipedia

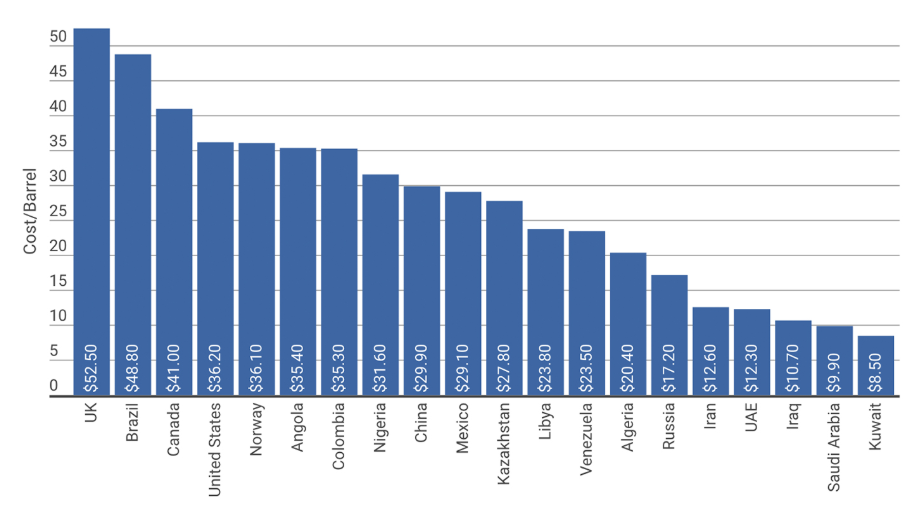

Cost of Oil Production

As a source for information Rystad Energy release a list of total cost (capital expenditure + operational expenditure) for major oil producing countries and here is the scoop:

From Well to Fumes

So what does a barrel of oil represent, let alone 13 million of them? It’s hard for people outside of the industry to visualize the production numbers, so let’s attempt to make sense of them. Most crude oil in the United States is used to make petroleum. Petroleum is used for fueling vehicles, providing electricity, heating buildings, making plastics, and many other goods. Current statistics are only available for 2018 where the U.S. consumed 20 million barrels per day, much higher than their own production levels.

The breakdown in the use of petroleum was: 69% transportation, 25% industrial, 3% residential, 2% commercial, and 1% electric power. Consumption of motor gasoline was 9.3 million barrels a day, 45% of petroleum consumption. Gasoline is clearly the leader in terms of petroleum use.

Pumping, Refining, and Distribution

Basic supply and demand theory states that the more of a product is produced, the more cheaply it should sell, all things being equal. It’s a symbiotic dance. The reason more was produced in the first place is because it became more economically efficien to do so. If someone were to invent a well stimulation technique that could double an oil field’s output for only a small incremental cost, then, with demand staying static, prices should fall.

In The United States production is high, but distribution and refinement aren’t keeping up with it. They are still catching up with the boom. The United States does not build refineries often. Six refineries were built between 2014-2019, to keep up with production, but before 2014, the last refinery was built in 1998. Currently, the U.S. has 135 refineries in operation. So even though there is a large supply of oil, the ability to refine it and get it to market is limited, affecting the actual supply that is available for consumption.

OPEC: Only So Much Influence

Then there’s the problem of cartels. The Organization of the Petroleum Exporting Countries (OPEC) was founded in the 1960s. Although the organization’s charter doesn’t state this explicitly, they fix prices. By restricting production, OPEC can force oil prices to rise, and thereby enjoy greater profits than if its member countries had each sold on the world market at the going rate. Throughout the 1970s and much of the 1980s, this was a sound if immoral strategy for OPEC.

Comment on the Saudi – Russia Price War March 2020

You can read about the events here . In summary Saudi and Russia could not agree on the price cut in the OPEC+ meeting. Saudi then raised its production to record levels while WHO announced a pandemic of Corona virus. Low demand, high supply ended up crude oil price hitting negative territory. Who you think is the winner from low oil prices? Is it a coincidence that 2nd (Saudi,$10) and 3rd (Russia ,$17) oil market share leaders enter a war to drop prices and 1st market leader (USA) has the highest cost of oil production between them at $36?

Could this be a long term strategy to stop USA to gain more market share? It would be cheaper to buy Saudi oil shipped than produce yourself.

Foreign Unrest

The oil industry is a global game and what happens in the world impacts the price of oil, especially since a large proportion of the world’s biggest oil producers are in unstable areas, mainly the Middle East. Saudi Arabia, Iraq, Iran, Kuwait, and Libya all fall in this region. Russia has been a nefarious player in global politics and suffered sanctions for being so, and Venezuela is in a political crisis. Terrorist attacks, sanctions, and other regional matters influence how these countries supply oil, which then determines how oil prices move. If these countries cannot supply oil because they are impeded from doing so, and demand remains constant, oil prices will go up.

2019 saw plenty of these regional impacts. The terrorist bombings on Saudi oil fields, renewed sanctions on Iran, Venezuela in turmoil, tanker bombings in the Gulf of Oman, and pipeline contaminations in Russia, are only some of the regional disasters beleaguering the oil industry.

The Bottom Line

The oil industry is a complex one with many different components and many different players. Natural laws of supply and demand come in to play, as with any free-market, but each is impacted by the components that make up the oil industry, such as refining capability, oil reserves, and foreign affairs.