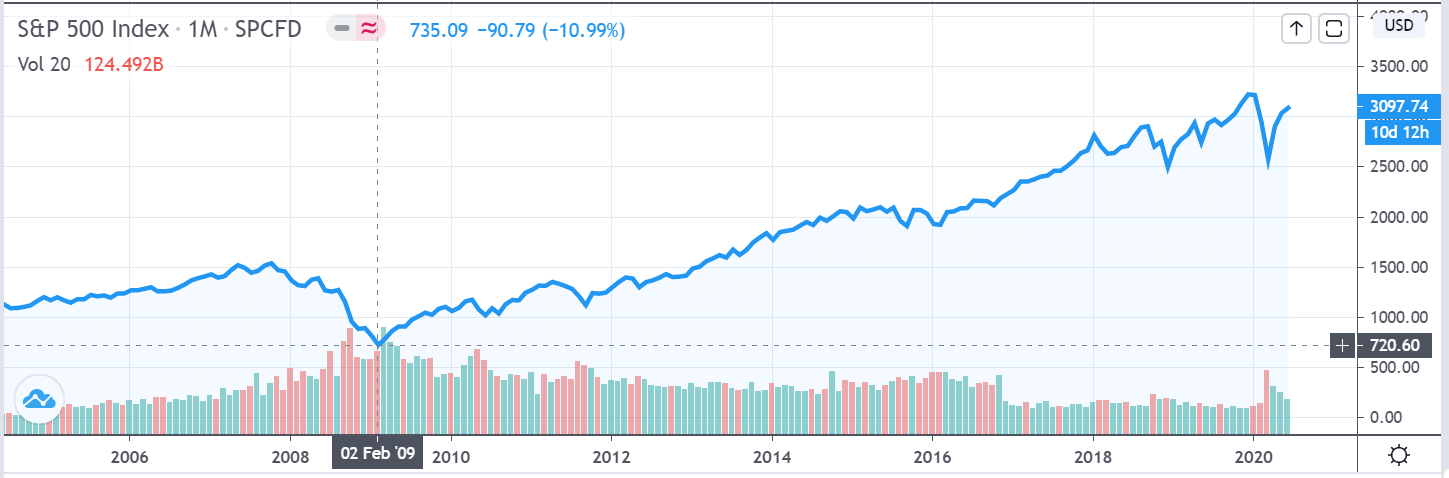

MES is the ticker name for Micro E-mini S&P 500 Index Fund Futures. Check out below graph for long term performance of S&P500.

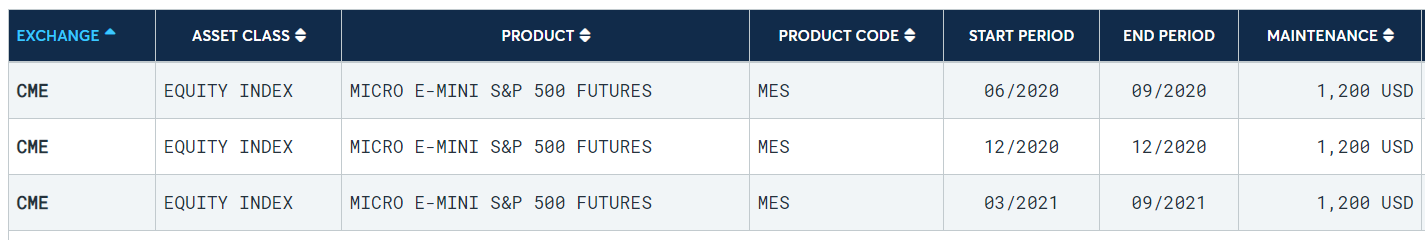

MES contract specifications:

- Micro E-mini S&P 500 futures (MES) offer smaller-sized versions of our liquid benchmark E-mini contracts

- They are designed to manage exposure to the 500 U.S. large-cap stocks tracked by the S&P 500 Index, widely regarded as the best single gauge of the U.S. stock market

- The Micro E-mini S&P 500 futures contract is $5 x the S&P 500 Index and has a minimum tick of 0.25 index points

- Trading Hours : CME Globex: Sunday – Friday 6:00 p.m. – 5:00 p.m. Eastern Time (ET) with trading halt 4:15 p.m. – 4:30 p.m.

For the full contract specifications you can visit CME Group website

You should take this free course to understand more about Future Markets.

How much one contract cost?

Each contract value is five times current price of the MES. Assume S&P500 is at 3000 points then MES contract value is $15K. Maintenance Margin (mntmgn) requirement for one contract is $1200. This is very high leverage around 12X.

Note that Futures Contracts including MES in IBKR are not subject to SMA when you buy them. Review this example.

Target Amount for MES : $150,000 Equals to 10 MES Contracts with $12,000 mntmgn

It can be so easy to get greedy when you see you can invest large amount of $$ with leverage power. Always calculate your risk before you decide on the quantity of contracts to buy. Trouble hits you when contract value goes down. For ex S&P500 dropped 20% while you were holding 10 contracts. This would deduct 20% of $150,000 that is –$30,000 cash from your account.

What if you purchased ETF like VOO, SPY, VUSD instead of MES?

Target Amount for ETF : $150,000 with $37,500 mntmgn impact, $75,000 SMA Impact

IBKR allows you to use 4X leverage in US equities. Check your margin requirements before you purchase within your broker platform. For ex S&P500 dropped 20% while you were holding $150,000 worth. Your mntmgn requirement goes down to $30,000 in parallel to the Index price. Your excess liquidity (exliq) would reduce by $30,000.

So the main difference is MES does not require to hold much cash at the time of purchase and offers 12X leverage. Index Funds in ETF forms act like buying a stock with 4X leverage.

Futures Contract Rollover Structure

Notice MES contracts are rolling over every 3 months. Oil future contracts roll over monthly. Unlike Oil or Gold contracts there is no physical delivery in Index Fund so there is no contango impact.

| CONTRACT MONTH | PRODUCT CODE | FIRST TRADE | SETTLEMENT |

| LAST TRADE | |||

| Jun-20 | MESM20 | 15-Apr-19 | 19-Jun-20 |

| 19-Jun-20 | |||

| Sep-20 | MESU20 | 21-Jun-19 | 18-Sep-20 |

| 18-Sep-20 | |||

| Dec-20 | MESZ20 | 20-Sep-19 | 18-Dec-20 |

| 18-Dec-20 | |||

| Mar-21 | MESH21 | 20-Dec-19 | 19-Mar-21 |

| 19-Mar-21 | |||

| Jun-21 | MESM21 | 20-Mar-20 | 18-Jun-21 |

| 18-Jun-21 | |||

| Sep-21 | MESU21 | 19-Jun-20 | 17-Sep-21 |

| 17-Sep-21 |

You can monitor MES in your iOS Stocks App by adding the symbol MESU20 for the current active front contract.

MES is the perfect investment for me for Index Fund investing. I can use leverage against my bond assets. Long term it is very bullish. I will update you how I get on with this in the coming months.