Understanding your account margin requirements can be very difficult especially for the new investors. I will demystify it for you so you do not get a margin call like I did!

What is Margin?

Margin is borrowing money from the broker to buy stocks, futures, commodities, bonds and options.

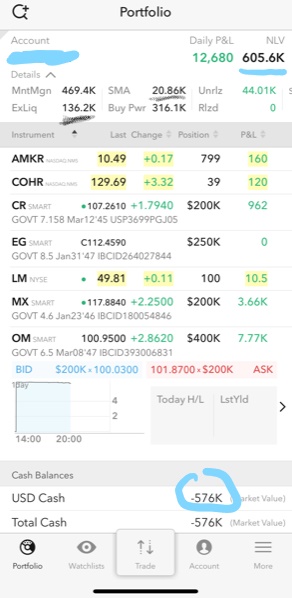

A Screenshot of Portfolio View in Interactive Brokers Mobile App

Net Liquidation Value : (NLV = $605.6K) Total cash value + stock value + bond value + fund value

Initial Margin: The minimum amount of equity required to open a new position.

Maintenance Margin: (MntMgn = $469.4K) The amount of equity required to maintain your current positions.

Available Funds: The amount of funds you have available for trading.

This is equal to Equity with Loan Value – Initial Margin.

Excess Liquidity: (ExLiq = $136.2K) This is your margin cushion.

This is equal to Equity with Loan Value – Maintenance Margin.

Buying Power: (BuyPwr = $316.1K) The maximum amount of equity available to buy securities. In a Margin account, Buying Power = Minimum (Equity with Loan Value, Previous Day Equity with Loan Value) – Initial Margin *4.

SMA: ($20.86K) SMA (Special Memorandum Account) is a line of credit created when the market value of securities in a Margin account increases in value and maintained for the purpose of applying Federal Regulation T initial margin requirements at the end of the trading day. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation.

USD Cash: -$576K

When do you receive a Margin Call a.k.a Liquidation?

You always have to keep your SMA and ExLiq value positive amount. Your account will be automatically liquidated if any of these value is <0.

Maintenance Margin is dynamic at 25% value for stocks for ex. Stock value goes down so as the maintenance margin.

SMA does not go down with the value of the stock.

How did I meet with my first margin call?

I had $200K in my account and wanted to buy Egypt Government Bond for a face value of $450K. I checked the margin requirements in the order entry by clicking “Check Margin” button. I could see 4:1 leverage $112.5K, that is the maintenance margin requirement. So I had $200K in my account which was bigger than the $112.5K MntMgn requirement. I was borrowing $250K from IBKR to open $450K position in this case. I went ahead and bought it. You can find more info about Fixed Income here.

The next day I check my account I can see that I have SMA=-$25K. So regardless of the leverage of the asset you can never borrow more than your cash. SMA rule is 2:1 leverage. So I would be on the edge if I bought $400K worth. I had $200K, borrow$200K so SMA would be $0. So I needed to add to my account $25K cash to be able to borrow another $25K then I would keep my bond. As I could not transfer $25K the same day my bond got liquidated automatically one hour before the session closure. They liquidate just enough to keep your SMA positive. For government bond min amount to trade is $200K so they sold $200K bond reducing my holding from $450K to $250K.

I found a good official resource to understand more about Interactive Brokers Margin Requirement.

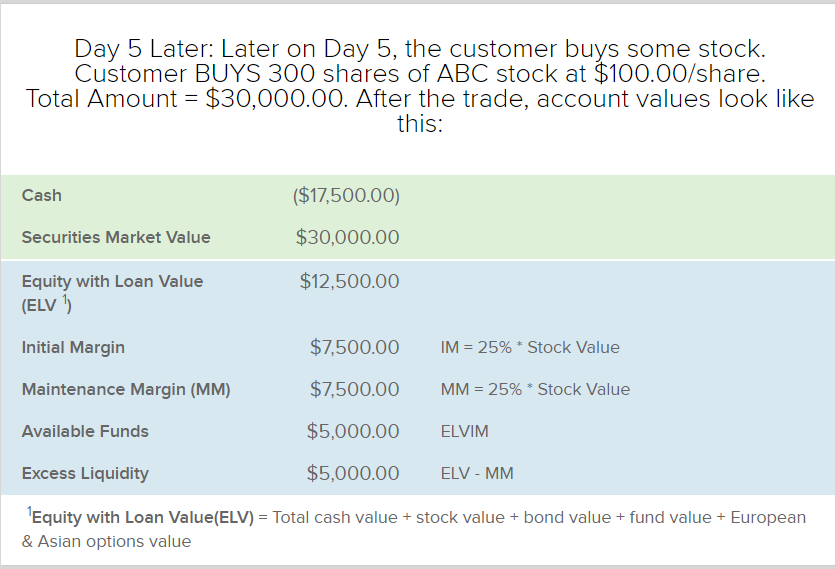

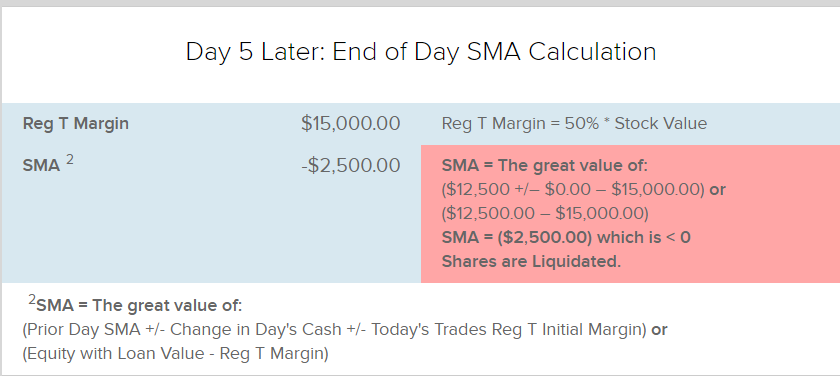

I like this example below which is similar to what happened in my situation.

Investor had $12.5K in his account. Invested in $30K worth of stocks by borrowing $17.5K. Here SMA is violated because $30K divided by 2 is $15K cash required in the account. This can also be referred as Reg T Margin Requirement. So this is what happened next;

Please do not forget to leave your feedback in the comments.

Thank you for your detailed explanation!

Appropriate it nuch for a rookie trying to trade on margin.

Hi Ali,

You are welcome. You always learn the hard way with some losses. Hopefully you understand it better and do not get burnt. Good luck managing your risk

Can you show with an example how to calculate futures buying power?

You may get to wrong conclusions by just looking at Buying Power because in IBKR by default it is calculated for equities (4X margin).

Assume you have the same account as in this blog post. Your Buying Power is 316.1K. Lets try to open a new ES futures contract trade.

Maintenance Margin for 1x ES Futures Contract face value $232,887, Maintenance Margin $15,321. So you could enter this trade as there are enough ExLiq in the account. You have to check each futures contract have different Margin Requirements and they are subject to change. When markets tumble broker firms increase margin requirements.

Another warning is that even though you can enter the trade, a 10% decrease in ES futures would end up eating from your ExLiq ($23,288). That will deduct as cash after you enter the trade. I hope that clarifies things a bit. If not send me more details about your account and I can try to help.

Hi I have recently opened an account

And have wondered what this had all meant noticed some charges ect I will have to do some more reading on this as they do not tell you obout this on there courses