I always think about the film The Big Short when I talk about this topic. Before I started trading I had to watch this film two times to make some sense of it. If you got it when you first watched it then you beat me to it 🙂

What is Shorting?

‘Short selling‘ or ‘Shorting‘ is an investment or trading strategy that speculates on the decline in a stock or other securities price. So you win if price goes down. It is the opposite of buying a stock. Most new traders are not aware of this trading strategy which can be very useful at times. Would not that be great you make money when most people are losing it on their Long positions. BTW Long position is a Buy position, Short position is a Sell position.

How to short a stock?

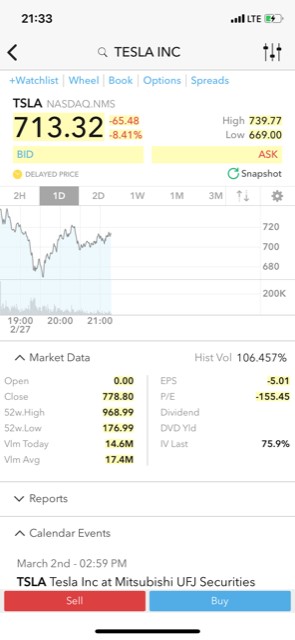

I show you an example on IBKR Mobile App how to short TSLA for ex; You add the stock to your watchlist and then click on the stock name

At the moment you do not own any TSLA shares. To start the short position you simply click on “Sell” and choose the Quantity of shares you want to sell. When your order is filled you have your “Short Selling” or “Shorting” started. In the example above TSLA is trading at the price of $713.32. Tomorrow you got so lucky and TSLA price dropped to $600. You would make $113.32 per share in this case. So you decided to close this Short position and take the profit. You have place an order to “Buy” type in order to close it. So if we summarize when you ‘Short’ you first “Sell” then “Buy”. When you go “Long” like most people do you first “Buy” and then “Sell”. So shorting is opposite of Buying a stock. Usually in a Bull market people go Long and in a Bear market people go Short. Hope that clarifies the matter.