Due to Reddit wallstreetbets pumping some of the stocks like GameStop (GME) and AMC , this has created a massive surge in volatility. For ex GME was trading at $12 per share during Dec 2020, one month later in January 2021 price spiked up to $350 per share. A week later price dropped to $46 and now trading at $130 on March 8th 2021. This unexpected sharp move created problem for brokers like Robinhood where most retail traders using.

I am using Interactive Brokers (ibkr) as my brokerage account. Have a look at some snippets from IBKR Margin FAQ Page:

“We are seeing unprecedented volatility in GME, AMC, BB, EXPR, KOSS and a small number of other U.S. securities that has forced us reduce the leverage previously offered to these securities and, at times, limit trading to risk reducing transactions. Outlined below are a series of FAQs relating to these actions.”

If you have a margin account be careful when you submit an order for some securities.

“IBKR has increased its margin requirements for securities in GME and the other US securities subject to the recent volatility, including up to 100% margin required for long positions and 300% margin on the short side. You can see these margin requirements in your trading platform prior to submitting an order.”

“Q: What allowed IBKR to place those restrictions?

A: Pursuant to its customer agreement, IBKR may decline to accept any customer’s order at IBKR’s discretion.

IBKR also has the right to modify margin requirements for any open or new positions at any time, in its sole discretion. After all, IBKR is the one whose money is being loaned in a margin trade.”

GME Example:

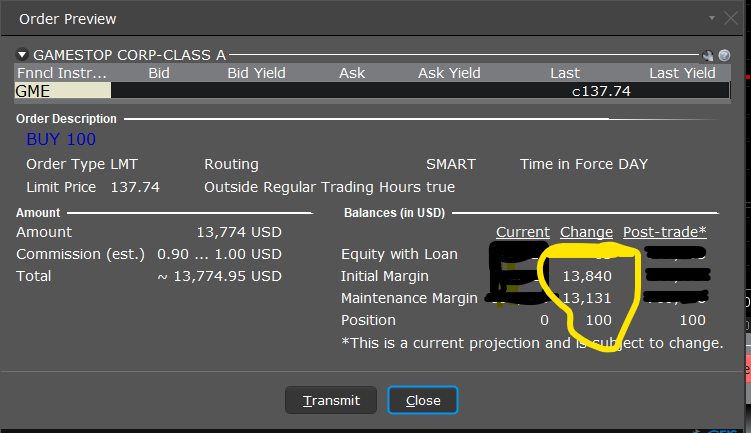

Let’s have a look at an example for GME, you want to buy 100 Shares of GME Stock at $137.74 price. When you check the maintenance margin (mntmgn) requirement before submitting an order you will see a screen like below

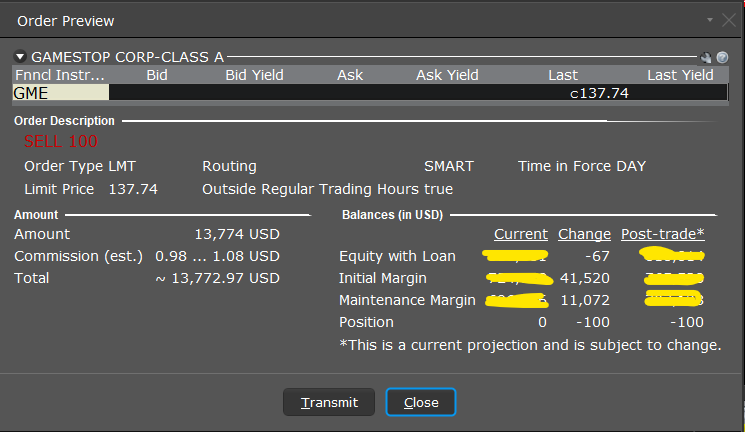

As you see above maintenance margin (mntmgn) requirement is 100% at $13840. Normally US stocks margin rate is 25%. More interestingly when you try to short / sell 100 shares see what happens below

You would require 300% margin at $41520 when you short GME. This is quite insane really.

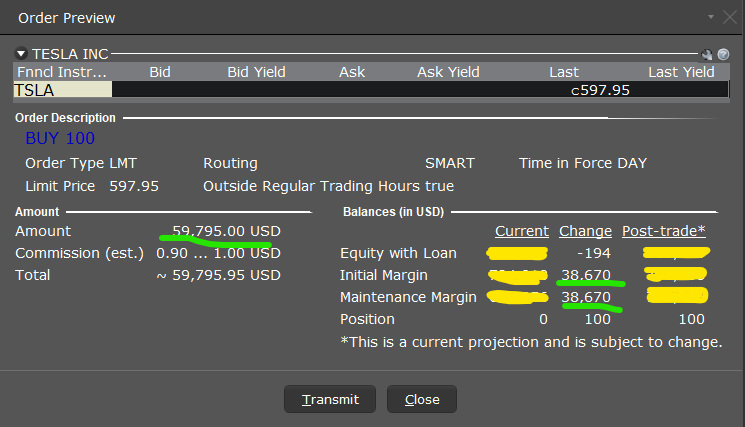

I am holding some Tesla Stock (TSLA) options and I have noticed TSLA stock Maintenance Margin (mntmgn) requirement increased too. See the TSLA order preview screen below

100 Shares X 597.95 = $59795 , margin requirement (mntmgn) is $38670 which equals to 64.5%

Another interesting find is the biotech stocks like Moderna (MRNA) also requires 100% margin.

Robinhood margin requirements have a reference page here stating;

”

Margin maintenance is the minimum Portfolio Value (minus any cryptocurrency positions) you need to maintain to avoid being issued a maintenance margin call.

Robinhood determines a stock’s maintenance requirement based on a model that considers certain factors, such as volatility and market liquidity. Stocks that are known to be more volatile, for example, typically have higher maintenance requirements to ensure you have enough Portfolio Value to cover the position if it quickly decreases in value. Please note that Robinhood has full discretion to adjust margin maintenance requirements at any time.

If your portfolio value (minus any cryptocurrency positions) falls below the margin maintenance requirement, you may be issued a maintenance margin call. You can resolve a margin call by closing positions or depositing funds into your account.

Example

Say you own $10,000 of MEOW. If Robinhood sets MEOW’s margin maintenance requirement at 25%, this means that you need to have at least $2,500 in account equity backing this investment.

If Robinhood increased MEOW’s margin maintenance requirement to 35%, you would then need to have $3,500 in account equity, because 0.35 x 10,000 = 3,500.”

As a summary always check your order preview screen about margin requirements as they may change per security from 25% to %64.5 to 100% on the fly without any notice. Make sure you have positive ExLiq and SMA not to go through automatic liquidation.